In the realm of securing one's assets and ensuring a smooth transition of wealth, the expertise of estate planning attorneys stands as an invaluable asset. These professionals navigate the intricate landscape of wills, trusts, and tax implications with a finesse that can safeguard one's legacy for generations to come.

By delving into strategies that protect assets and streamline the transfer of wealth, estate planning attorneys offer a sense of security and peace of mind that transcends mere financial planning.

As individuals map out their future financial landscape, the guidance provided by estate planning attorneys becomes not just beneficial, but essential in paving the way for a secure and prosperous legacy.

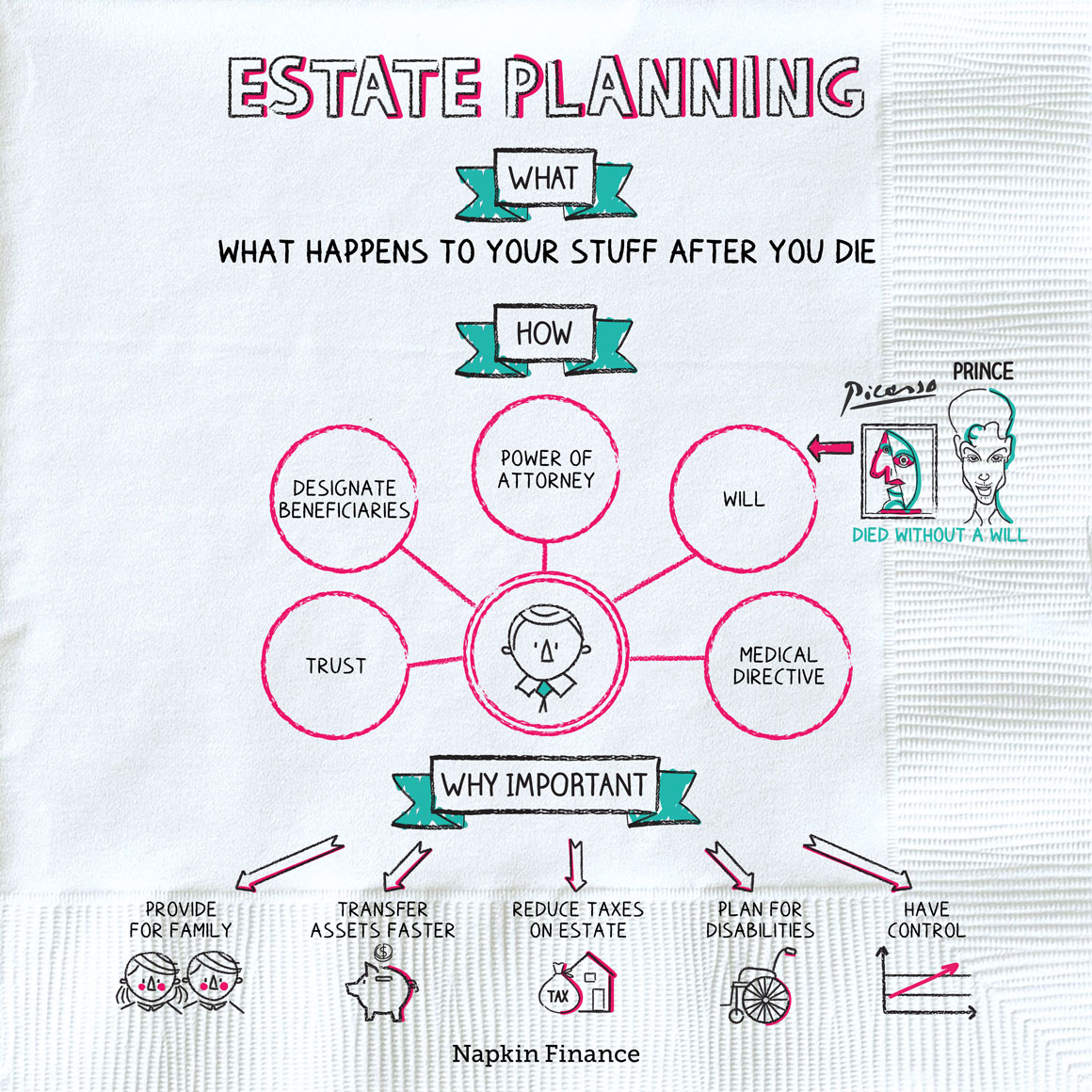

Estate planning attorneys play a crucial role in ensuring that individuals' assets are protected and distributed according to their wishes upon their passing. These legal professionals specialize in creating comprehensive plans that outline how a person's assets, such as property, investments, and personal belongings, will be managed and distributed after death.

By working closely with clients to understand their unique circumstances and objectives, estate planning attorneys can help minimize potential estate taxes, avoid probate delays, and ensure that beneficiaries receive their intended inheritances promptly.

Overall, estate planning attorneys offer invaluable expertise in navigating complex legal processes to safeguard assets and provide peace of mind for their clients.

In the realm of estate planning, the meticulous drafting of wills and trusts is a fundamental aspect that requires careful consideration and expertise. Crafting wills involves outlining how assets and properties are to be distributed upon the testator's passing, ensuring that their wishes are carried out efficiently.

Trusts, on the other hand, provide a means to manage and distribute assets during and after the grantor's lifetime, often offering benefits such as privacy, avoiding probate, and potentially reducing estate taxes.

Estate planning attorneys play a crucial role in helping individuals navigate the complexities of wills and trusts, ensuring that these legal documents accurately reflect their intentions and provide for their loved ones in the future. By engaging in thoughtful planning and documentation, individuals can secure their legacy and protect their assets for generations to come.

When structuring wills and trusts, a key consideration is strategizing methods to minimize tax implications for the estate and beneficiaries. Estate planning attorneys play a crucial role in helping individuals navigate the complex tax landscape to preserve wealth for future generations.

By implementing strategic estate planning techniques, such as establishing irrevocable trusts, utilizing annual gift tax exclusions, and taking advantage of applicable deductions, individuals can reduce the tax burden on their estates.

Careful planning can also help in maximizing the assets passed on to beneficiaries, ensuring that more of the estate is preserved for their benefit. By staying informed about current tax laws and working closely with experienced estate planning professionals, individuals can effectively minimize tax implications and secure their legacy for the future.

Efficiently navigating the legal complexities of transferring assets after one's passing can involve strategies aimed at bypassing the probate process. Probate, the court-supervised process of distributing a deceased person's assets, can be time-consuming and costly.

One effective way to avoid probate is by establishing a revocable living trust. Assets placed in a trust are not subject to probate, allowing for a smoother and more private transfer of wealth to beneficiaries. Additionally, designating beneficiaries on assets such as retirement accounts and life insurance policies can help avoid probate.

By carefully planning and structuring your estate to minimize probate involvement, you can potentially save your loved ones from the burdensome probate process and ensure a more efficient distribution of your assets.

Utilizing strategic planning techniques can safeguard your legacy and ensure the protection of your assets for future generations. Legacy protection strategies encompass a range of tools and approaches aimed at preserving and distributing wealth according to your wishes while minimizing potential risks.

One key strategy is establishing a trust, which allows you to dictate how your assets will be managed and distributed, potentially reducing estate taxes and avoiding probate. Additionally, implementing asset protection measures, such as insurance policies and business structures, can shield your wealth from creditors or legal claims.

Regularly reviewing and updating your estate plan in accordance with changes in laws or personal circumstances is crucial to maintaining the effectiveness of your legacy protection strategies.

Achieving a sense of tranquility and assurance stems from meticulous estate planning guided by experienced attorneys.

By proactively addressing potential challenges and uncertainties through comprehensive estate planning, individuals can ensure that their wishes are carried out effectively, providing peace of mind for themselves and their loved ones. Estate planning allows for the orderly distribution of assets, minimizes tax liabilities, and can help avoid family disputes or legal battles.

Through strategies such as wills, trusts, powers of attorney, and healthcare directives, individuals can plan for contingencies, ensuring that their affairs are managed according to their desires. With the guidance of estate planning attorneys, individuals can navigate the complexities of estate planning with confidence and security.

Selecting an executor for your estate involves careful consideration. Start by identifying someone you trust to carry out your wishes efficiently. Consider their financial acumen, organizational skills, and ability to manage potential conflicts among beneficiaries. Discuss the responsibilities with your chosen executor in detail to ensure they are willing and capable. It is advisable to select a backup executor in case the primary choice is unable to fulfill the role.

Estate planning can indeed help protect assets in the event of a divorce or lawsuit. By strategically structuring trusts, establishing limited liability entities, and utilizing other legal tools, individuals can safeguard their assets from potential creditors or claims from a divorcing spouse. Properly crafted estate planning can provide a layer of protection, ensuring that assets are preserved and managed according to the individual's wishes even in challenging legal situations.

Estate planning can be a strategic tool to help minimize estate taxes for beneficiaries by utilizing various techniques and tools such as setting up trusts, making lifetime gifts, and establishing tax-efficient structures for asset distribution. By working closely with a skilled estate planning attorney, individuals can structure their estate plans to take advantage of tax-saving opportunities, ultimately reducing the tax burden on beneficiaries and maximizing the assets passed on to loved ones.