Estate planning is a critical process that requires careful consideration and strategic foresight to ensure the effective management and distribution of one's assets.

Engaging a knowledgeable attorney can provide tailored insights into various components such as wills, trusts, and asset protection strategies, while also addressing the intricate tax implications that may arise.

Understanding the importance of selecting the right executor and regularly reviewing your estate plan can further safeguard your legacy. However, many individuals overlook key aspects that could significantly impact their estate plans, raising the question of what strategies might be essential yet often neglected.

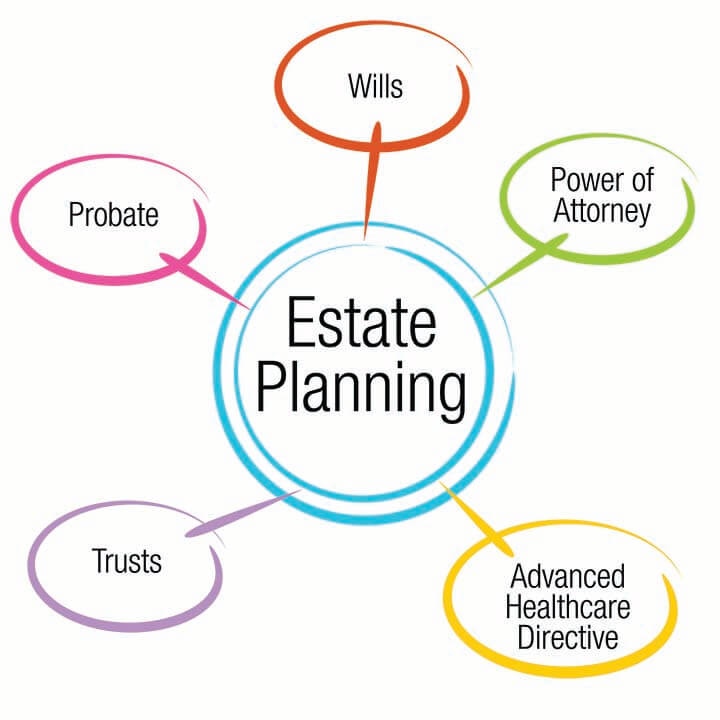

Understanding estate planning is crucial for individuals seeking to manage their assets and ensure that their wishes are honored after their passing. Estate planning involves a comprehensive strategy to prepare for the distribution of one's assets, addressing not only financial matters but also healthcare and guardianship decisions.

Key components include identifying beneficiaries, selecting executors, and establishing powers of attorney. Additionally, it encompasses considerations for tax implications and the potential need for asset protection. An effective estate plan is tailored to individual circumstances, reflecting personal goals and values.

Engaging with legal and financial professionals ensures that the plan adheres to current laws and regulations, safeguarding the individual's intentions and providing peace of mind for both the planner and their loved ones.

Establishing a will or trust is a fundamental step in effective estate planning, as these legal instruments play a critical role in asset distribution and management after one's death.

A will outlines how assets should be allocated, appoints guardians for dependents, and specifies funeral arrangements, ensuring that an individual's wishes are honored. Conversely, a trust can provide more nuanced control over asset distribution, potentially allowing for the gradual transfer of wealth and protection against creditors.

Trusts may also assist in avoiding probate, expediting the transfer process, and maintaining privacy regarding estate details. Both wills and trusts are essential for minimizing conflicts among heirs, providing peace of mind, and ensuring that one's legacy is preserved according to specific intentions.

Employing robust asset protection strategies is essential for safeguarding wealth from potential creditors, lawsuits, and unforeseen financial challenges. Establishing irrevocable trusts can effectively shield assets, as they remove ownership from the grantor and protect them from claims.

Additionally, incorporating limited liability entities, such as LLCs or corporations, can provide a barrier between personal assets and business liabilities. Diversifying assets across different jurisdictions may also enhance protection, especially in states with favorable laws for asset protection.

Moreover, utilizing appropriate insurance policies, including umbrella coverage, can further mitigate risks. Regularly reviewing and updating these strategies with a knowledgeable attorney ensures they remain effective and compliant with changing laws, providing peace of mind for both individuals and families.

Selecting an appropriate executor is a critical decision in the estate planning process, as this individual will be responsible for managing the distribution of assets and ensuring that the deceased's wishes are honored. When choosing an executor, consider their financial acumen, organizational skills, and ability to remain impartial.

It is also essential to select someone who can devote the necessary time and energy to fulfill these responsibilities. Family members or close friends may be ideal candidates, but ensure they have the emotional resilience to handle potential conflicts.

Additionally, appointing a professional, such as an attorney or financial advisor, may provide the expertise needed for complex estates. Ultimately, the right executor can significantly impact the efficiency and effectiveness of the estate settlement process.

Regularly reviewing your estate plan is essential to ensure that it remains aligned with your current wishes and circumstances. Life events such as marriage, divorce, the birth of a child, or significant changes in financial status can greatly impact your estate planning needs.

Additionally, changes in tax laws and regulations may necessitate adjustments to your plan to maximize benefits for your heirs. Schedule annual reviews with your attorney to discuss these factors, updating beneficiaries, and reevaluating asset distribution.

This proactive approach not only helps to avoid conflicts among family members but also ensures that your intentions are clearly documented and legally sound. By maintaining an updated estate plan, you can provide peace of mind for both yourself and your loved ones.

Estate planning attorneys safeguard confidentiality and privacy by adhering to strict attorney-client privilege laws. They maintain the confidentiality of all personal information shared during consultations, document preparation, and any other interactions. Additionally, reputable attorneys implement secure data storage systems and ensure that only authorized staff members have access to sensitive information. By following these protocols, estate planning attorneys prioritize client privacy and provide a secure environment for discussing and managing personal affairs.

Estate planning attorneys stay current on changing tax laws and regulations through continuous education, attending seminars, workshops, and webinars, and engaging in professional development opportunities. They may also subscribe to legal publications, participate in specialized training programs, and collaborate with tax professionals to enhance their knowledge and expertise. By staying informed about the latest tax laws and regulations, estate planning attorneys can provide clients with accurate and up-to-date advice to ensure effective estate planning strategies.

Estate planning can help ensure your wishes are carried out in the event of incapacity by establishing legal documents such as a durable power of attorney and advance healthcare directive. These documents designate trusted individuals to make financial and medical decisions on your behalf if you become unable to do so. By proactively planning for incapacity, you can protect yourself and your assets while ensuring that your wishes are respected during challenging times.