In the competitive landscape of forex trading, choosing the right broker can significantly influence your profitability and overall trading experience.

It is essential to align your broker selection with your specific trading objectives, risk appetite, and preferred strategies. Regulatory compliance, platform usability, cost structures, and customer support are critical factors to consider.

As we explore these elements further, you may find that the nuances of broker selection could be the key to unlocking your trading potential. What specific criteria will guide your decision-making process in this critical choice?

When embarking on your forex trading journey, it's essential to first assess your individual trading needs and goals. Understanding your specific requirements will enable you to select a broker that aligns with your trading style and objectives.

Consider factors such as your preferred trading strategies, risk tolerance, and available capital. Are you a day trader seeking rapid execution, or a long-term investor focusing on broader market trends? Additionally, evaluate the types of instruments you wish to trade, such as currency pairs, commodities, or indices.

Your trading frequency and desired leverage will also play a critical role in determining the most suitable broker. Ultimately, a thorough understanding of your trading needs is vital for establishing a successful and sustainable trading experience.

Selecting a broker that meets your trading needs also involves scrutinizing their regulatory compliance. Regulatory oversight is crucial in ensuring that your broker operates within a framework that protects your interests and investments.

Look for brokers regulated by reputable authorities such as the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, or the Australian Securities and Investments Commission. These organizations enforce strict guidelines regarding financial practices, transparency, and client protection.

Additionally, verify whether the broker is a member of compensation schemes, which can provide further security for your capital in the event of broker insolvency. Prioritizing regulatory compliance will significantly mitigate risks associated with forex trading.

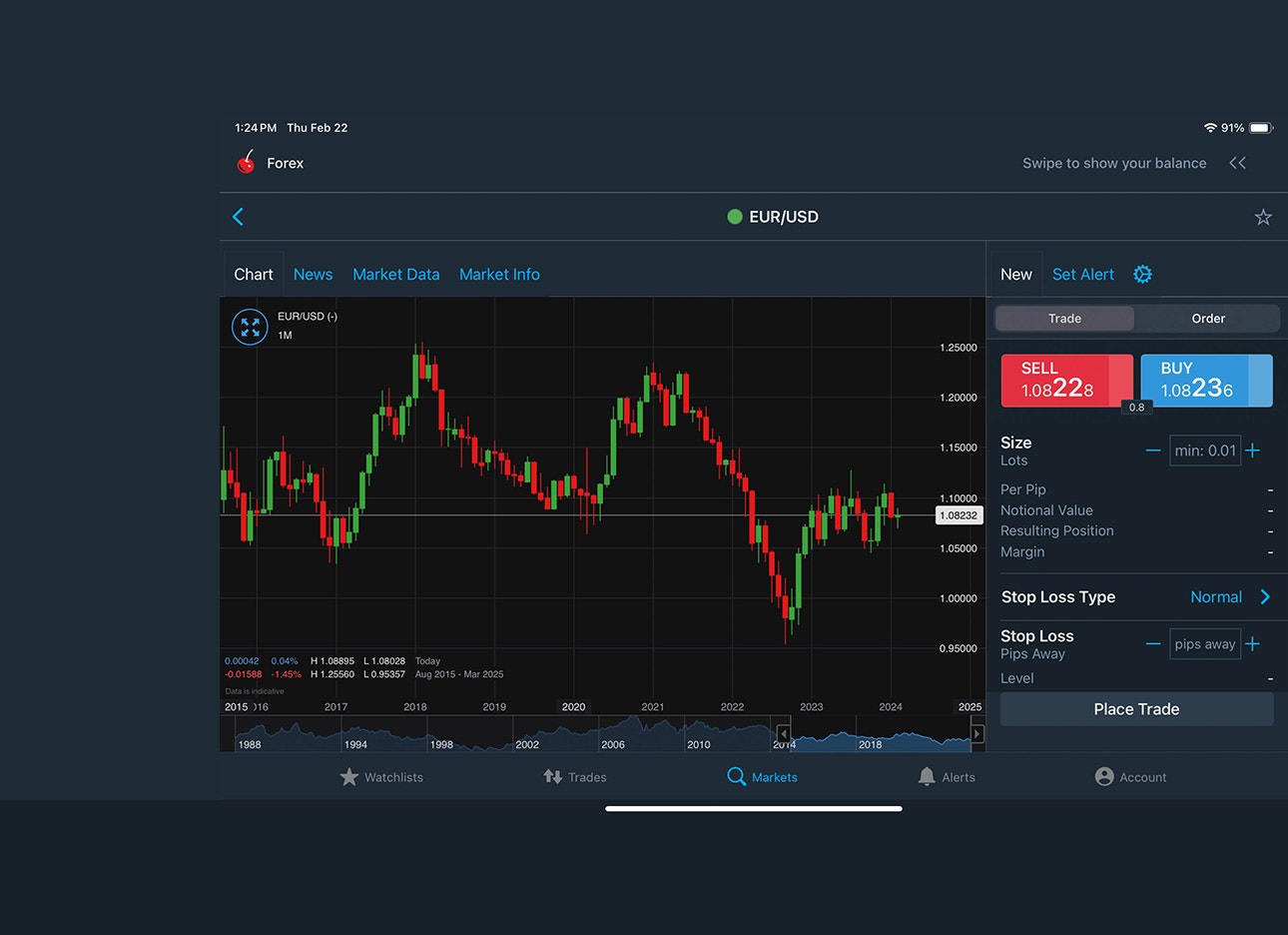

A broker's trading platform is a critical component of your forex trading experience, as it directly influences your ability to execute trades efficiently and manage your account effectively. When evaluating trading platforms, consider user interface design and ease of navigation, as a well-structured platform can enhance your trading performance.

Look for essential features such as real-time charts, technical analysis tools, and customizable indicators, which can provide valuable insights for decision-making. Additionally, ensure that the platform supports various order types and offers reliable trade execution speeds.

Mobile compatibility is also crucial for traders who prefer to manage their accounts on the go. Finally, check for demo accounts that allow you to practice trading without financial risk before committing to a live account.

Understanding the fees and spreads associated with forex trading is essential for maximizing profitability and minimizing costs. Brokers typically charge either a commission per trade or a spread, which is the difference between the bid and ask prices of currency pairs.

Low spreads can significantly enhance profit margins, especially for high-frequency traders. It is crucial to compare these costs across different brokers, as they can vary widely. Additionally, some brokers may impose hidden fees, such as withdrawal or inactivity charges, which can eat into profits.

By carefully analyzing these factors, traders can select a broker that offers competitive pricing, ensuring that their trading strategy remains cost-effective while maximizing their overall potential for profit.

When evaluating a forex broker, it's essential to weigh the quality of customer support provided. Effective customer service can significantly impact your trading experience, especially in a fast-paced market. Look for brokers that offer multiple channels of communication to ensure accessibility.

Additionally, assess the availability of support; 24/7 service is ideal for traders operating in various time zones. Test the responsiveness by reaching out with inquiries; prompt and knowledgeable responses indicate a commitment to client satisfaction.

Furthermore, consider the availability of educational resources, as brokers that invest in client education often provide better support overall. Ultimately, strong customer support can enhance your trading journey and help navigate challenges more effectively.

Reading broker reviews is a vital step in the selection process, as they provide insights into the experiences of other traders. These reviews can reveal critical information about a broker's reliability, execution speed, and overall user experience.

Look for patterns in feedback regarding trading platforms, fees, and customer service. Pay attention to both positive and negative reviews, as they can offer a balanced perspective on the broker's strengths and weaknesses.

Additionally, seek out reviews from reputable sources or established trading communities to ensure the information is credible. By carefully evaluating broker reviews, you can make a more informed decision, ultimately enhancing your trading experience and boosting your potential profits in the Forex market.

Many forex brokers offer bonuses or promotions to attract new traders, which can include welcome bonuses, deposit matching, or risk-free trades. These incentives may vary significantly in terms of their structure and conditions, such as minimum deposit requirements or trading volume obligations. It is essential for traders to thoroughly review the terms and conditions associated with these promotions to ensure they align with their trading strategies and financial goals.

Leverage significantly amplifies both potential profits and risks in trading. By allowing traders to control larger positions with a smaller capital outlay, it can enhance returns on successful trades. However, this increased buying power also magnifies losses, potentially leading to rapid depletion of capital. Consequently, while leverage can be a powerful tool for profit generation, it necessitates careful risk management strategies to avoid significant financial setbacks. Understanding leverage's dual nature is crucial for informed trading decisions.

The average time for fund withdrawals from forex brokers can vary significantly, typically ranging from 1 to 5 business days. Factors influencing this timeframe include the broker's processing procedures, the chosen withdrawal method (e.g., bank transfer, credit card, or e-wallet), and potential verification requirements. It is essential for traders to review the specific terms and conditions of their chosen broker to understand the anticipated withdrawal timelines, as well as any possible fees associated with the process.