In today's fast-paced environment, the importance of an efficient mileage tracker app cannot be overstated, particularly for professionals seeking to streamline their expense management.

Key features such as automatic trip logging, GPS integration, and a user-friendly interface play a critical role in enhancing the app's functionality. Furthermore, robust expense reporting tools and customizable mileage rates aligned with IRS guidelines provide essential support for financial accuracy.

As we consider the myriad options available, it becomes crucial to explore additional elements that can elevate the user experience and ensure data security. What other features might significantly impact your choice?

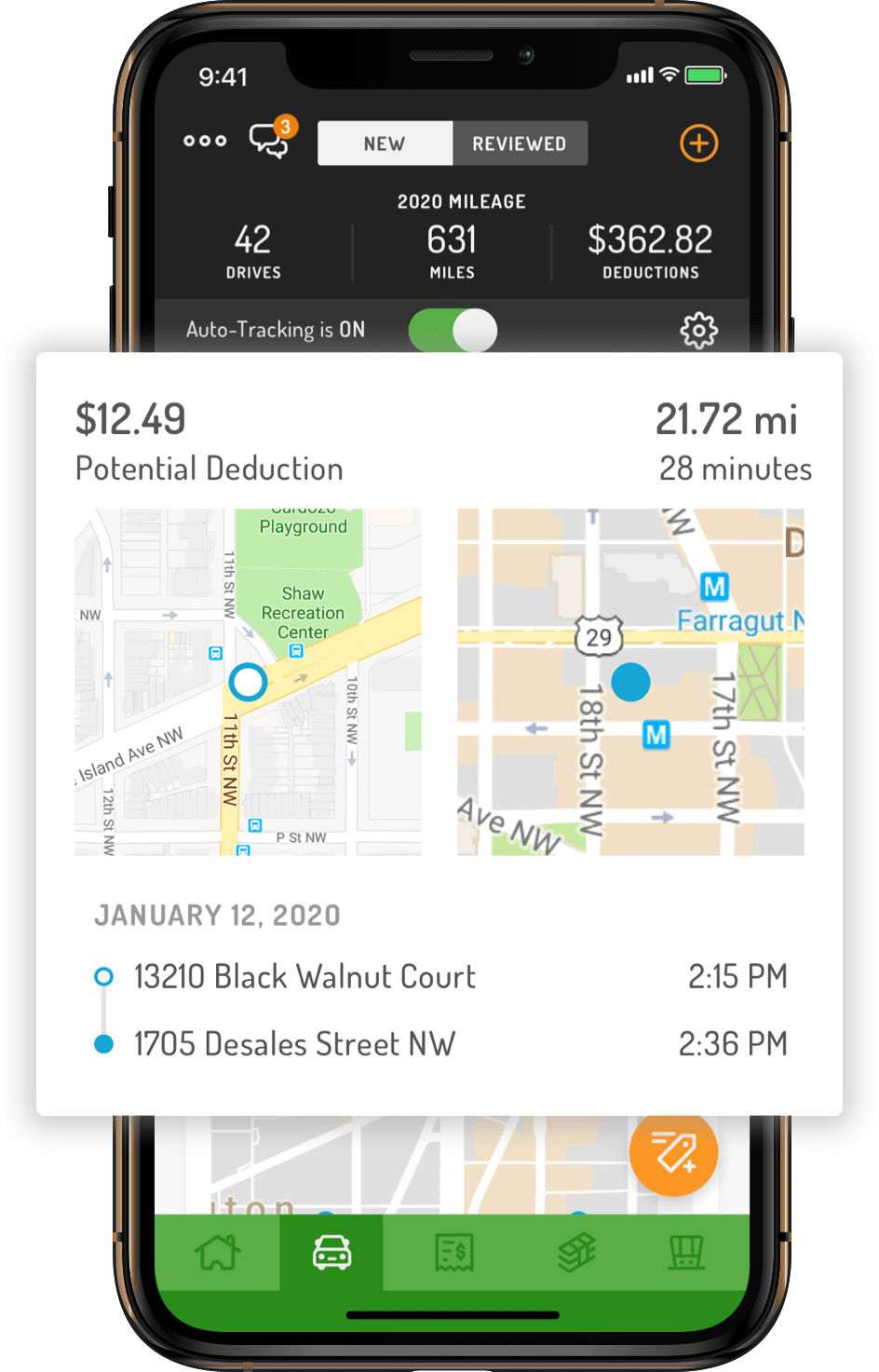

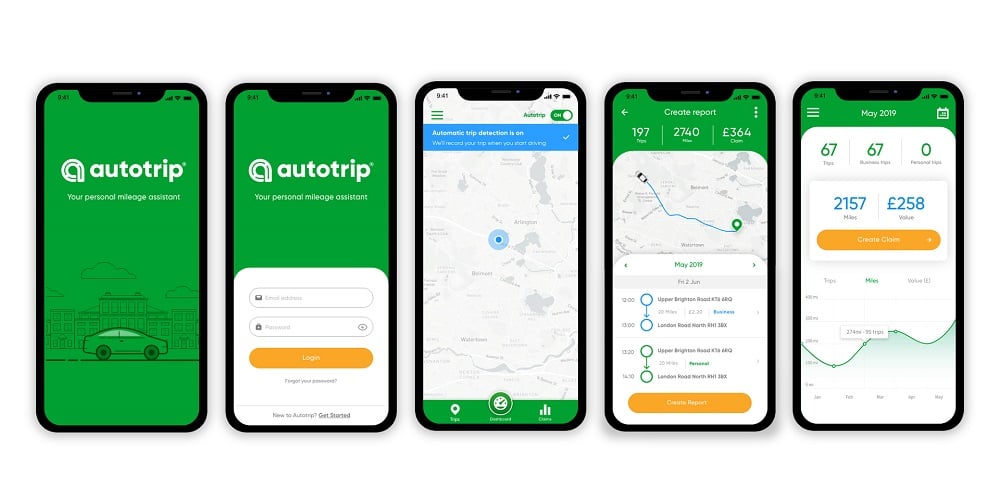

Automatic trip logging revolutionizes the way users track their mileage by seamlessly recording every journey without manual input. This feature enhances accuracy, eliminating the potential for human error associated with manual entry. Users benefit from real-time tracking, which captures essential trip details such as distance traveled, time spent, and routes taken.

Furthermore, automatic trip logging simplifies the process of categorizing trips for personal or business use, ensuring compliance with tax regulations and reimbursement policies. The convenience of this technology allows users to focus on their driving rather than paperwork, ultimately saving time and reducing stress.

As mileage tracking becomes increasingly vital for both individuals and businesses, automatic trip logging stands out as an indispensable tool in modern mileage tracker apps.

Integrating GPS technology into mileage tracker apps enhances the functionality of automatic trip logging by providing precise location data for each journey. This feature allows users to effortlessly track the start and end points of their trips, ensuring accurate mileage calculations.

GPS integration also minimizes the risk of human error, which can occur when manually entering trip details. Additionally, many apps utilize GPS to analyze driving routes, offering insights into the most efficient paths and potential shortcuts.

This not only aids in accurate mileage tracking but can also contribute to fuel savings and improved time management. By leveraging GPS technology, users can maintain comprehensive records, facilitating easier expense reporting and compliance with tax regulations.

A user-friendly interface is essential for the success of mileage tracker apps, as it directly impacts user engagement and satisfaction. An intuitive design enables users to navigate the app effortlessly, ensuring they can log their mileage quickly and accurately.

Key elements of a user-friendly interface include clear menus, easily accessible features, and a responsive layout that adapts to various devices. Additionally, visual cues, such as icons and color-coded elements, can facilitate understanding and streamline the tracking process.

A well-designed interface minimizes the learning curve, allowing users to focus on their mileage tracking rather than struggling with complicated navigation. Ultimately, a seamless user experience fosters loyalty and encourages continued use of the app, making it a critical feature for any reliable mileage tracker.

While tracking mileage is crucial, having robust expense reporting tools within a mileage tracker app enhances its functionality and value for users. These tools allow individuals and businesses to seamlessly document related expenses, such as fuel, tolls, and maintenance costs, alongside their mileage records.

This integration simplifies the expense management process, making it easier to generate comprehensive reports for tax purposes or reimbursement requests. Additionally, effective expense reporting tools can categorize expenditures, provide insights into spending patterns, and facilitate quicker approvals.

Users benefit from features like receipt scanning, automated calculations, and customizable reporting formats, ensuring that all relevant financial data is organized and easily accessible. Ultimately, these tools transform a simple mileage tracker into a comprehensive financial management solution.

Expense reporting tools provide a solid foundation for effective financial management, and customizable mileage rates further enhance the capabilities of a mileage tracker app. This feature allows users to tailor mileage reimbursement rates according to their specific needs, whether adhering to IRS guidelines or company policies.

By enabling customization, users can ensure accurate reimbursement for business travel, which in turn fosters greater financial accountability and transparency. Additionally, the ability to adjust rates based on vehicle type or travel purpose allows for a more nuanced approach to expense tracking.

This flexibility not only streamlines the reimbursement process but also helps organizations maintain compliance with evolving regulations, ultimately contributing to improved financial oversight and employee satisfaction.

Given the sensitive nature of financial data, robust data security measures are essential for any mileage tracker app. Users must ensure that the app employs strong encryption protocols to safeguard personal and financial information during transmission and storage.

Multi-factor authentication (MFA) adds an additional layer of security, making unauthorized access significantly more difficult. Regular security audits and compliance with data protection regulations, such as GDPR or CCPA, are crucial indicators of an app's commitment to user safety.

Furthermore, a privacy policy that clearly outlines data usage and sharing practices fosters transparency and trust. Selecting a mileage tracker app with these security features not only protects user data but also enhances the overall reliability and credibility of the application.

Yes, many mileage trackers are designed to accommodate multiple vehicles, allowing users to efficiently track mileage across different automobiles. This feature is particularly beneficial for businesses with a fleet or individuals managing personal and work-related vehicles. Users can often switch between vehicles within the application, ensuring accurate logging and reporting for each one. It is advisable to select a mileage tracking solution specifically highlighting multi-vehicle capabilities to optimize functionality and usability.

If you lose your mileage tracking device, it may hinder your ability to accurately record business travel expenses. In such cases, it is advisable to check if your solution offers a backup or cloud-based feature that retains historical data. Additionally, you should consider using alternative methods for tracking, such as mobile applications or manual logs, until you replace the device. Promptly reporting the loss may also help retrieve the device if it is found.

Tracking personal mileage can be beneficial for tax deductions, but only under specific circumstances. Generally, only mileage incurred for business purposes is deductible. To accurately track and substantiate these expenses, it is advisable to maintain detailed records of business-related travel, including dates, destinations, and purposes. While personal mileage is not deductible, keeping comprehensive records can help clarify the distinction between personal and business travel, ensuring compliance with tax regulations.